Honglu Group: A High-Beta Play in Pro-Cyclical Allocation, Offering Both Safety Margin and Growth Potential

In pro-cyclical investment allocations, are you always looking for targets with "high elasticity and stable fundamentals"? Today, we will delve into Honglu Steel Structure, which, due to its deep ties to the infrastructure sector, offers even greater elasticity. Next, we will dissect its investment value from the perspectives of company fundamentals, industry structure, cost advantages, and demand logic.

Ⅰ.Company Fundamentals: Anhui's Steel Structure Leader, Witnessed Valuation Breakout in 2020

Honglu Steel Structure's origins are clear: headquartered in Hefei, Anhui, founded in 2002, and listed in 2011. However, note that the company's true stock price breakout occurred during the 2020 market surge, driven by the resonance of its business logic with the market cycle.

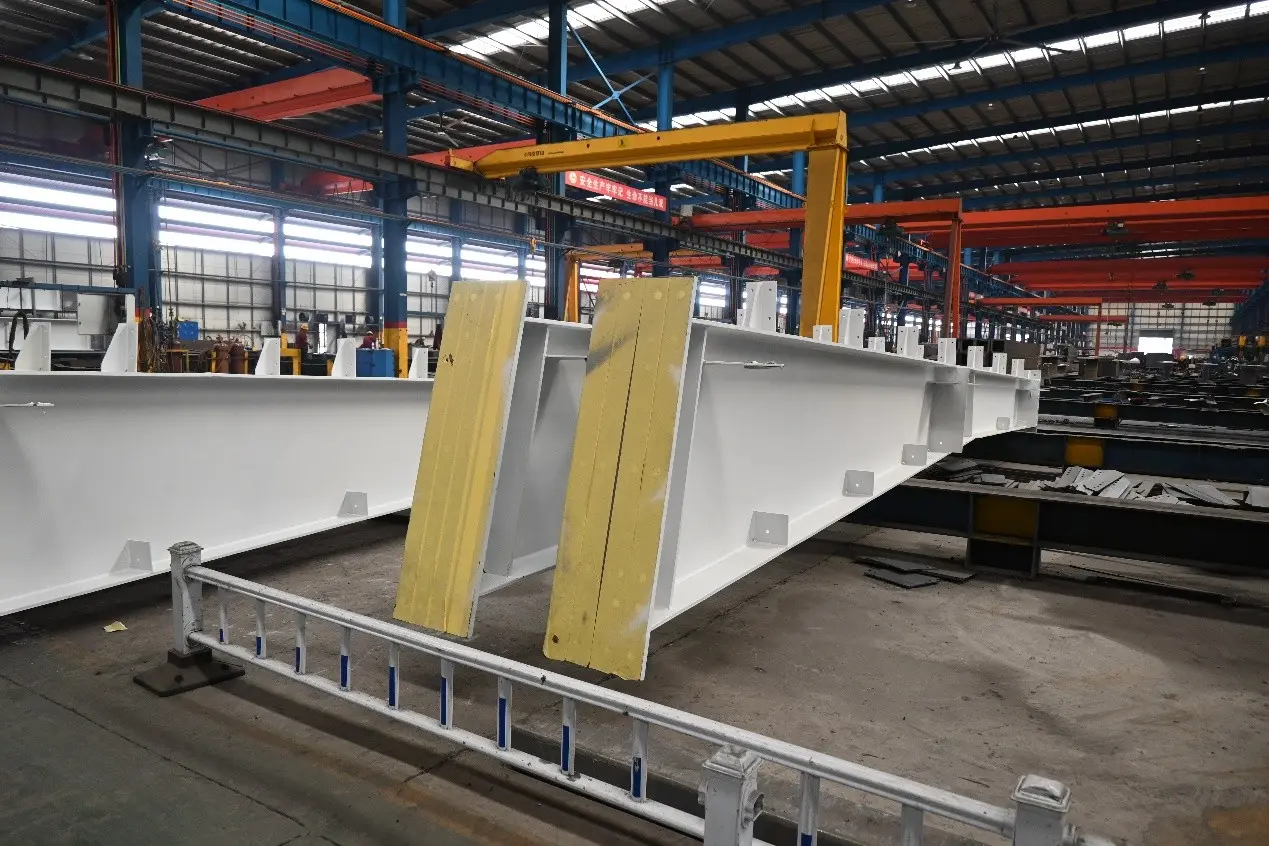

In essence, it is not a traditional steel producer but a "steel processor": it purchases raw materials like hot coil and medium plate from steel mills and processes them into steel structure products. These products are highly focused on specific application scenarios – large factories, bridges, hospitals, schools, stadiums, and other large public infrastructure projects. Simply put, it "follows infrastructure," with very low correlation to real estate, which also sets the stage for its subsequent pro-cyclical elasticity.

Its business model adopts a "steel price + processing fee" pricing structure, resulting in a clear profit model. It can benefit from the elasticity brought by steel price fluctuations while locking in basic profits through processing fees, ensuring fundamental stability.

Ⅱ.Industry Structure: Low Barriers + High Competition, But Matthew Effect Highlights Leading Advantages

Looking beyond the company, the Steel Structure Industry it operates in has a distinct characteristic: low barriers to entry and intense competition. From a business model perspective, it's difficult to assign high valuations to companies in this industry. Interestingly, however, the industry's "fragmented nature" highlights Honglu Steel Structure's leading position.

Market share data clearly shows this: Honglu Steel Structure ranks first in the industry with about a 6% market share, while other companies' shares are significantly lower. Although overall industry barriers are low, the "Matthew Effect" is vividly evident here – leading enterprises have significantly lower costs than mid- and tail-tier players, and Honglu Steel Structure is a direct beneficiary of this effect.

Simply put, the more intense the industry competition, the easier it is for leading companies with strong cost control capabilities to "outperform." This is the core logic behind Honglu Steel Structure's ability to remain stable in a low-barrier industry.

Ⅲ.Cost Advantage: 3 Key Pillars in Building a "Moat" from Procurement to Cost Reduction

Honglu Steel Structure's cost advantage is not one-dimensional but stems from three pillars: "Procurement + Scale + Technology." This is key to its firm footing in the industry.

Procurement End: Bulk Purchasing Advantage Reduces Intermediate Costs

As an industry leader, Honglu Steel Structure's procurement volume is substantial enough to engage in direct bulk purchasing with steel mills, bypassing intermediaries like steel traders. Smaller enterprises, with their smaller purchase volumes, often cannot deal directly with mills and must procure through steel traders, incurring an additional markup, making their procurement costs considerably higher than Honglu's. At this step, Honglu wins at the "starting line."

Scale End: Operational Control + Cost Savings, Lower Labor Costs

Economies of scale also bring labor cost advantages – larger capacity leads to lower unit labor costs. More importantly, Honglu is a typical "operations-focused" company with expense control capabilities, further compressing cost space.

It's important to correct a misconception: it's not that "high market share causes low costs," but rather that "strong operational core drives scale expansion, which in turn reinforces cost advantages." That is, its cost advantage is essentially the result of "strong operational capabilities," not merely scale dividends, making this advantage more sustainable.

Technology End: Robot Substitution Opens Up Cost Reduction + Efficiency Gains

The future potential for cost reduction is even more promising – Honglu has invested heavily in robot applications. Calculations by Changjiang Securities provide a clear expectation: if the robot substitution rate reaches 50%, cost per ton could be saved by about 108 yuan. Currently, the company's robot substitution rate has reached 25%, saving about 54 yuan per ton.

More crucially, robots not only reduce costs but also increase capacity: liquid component production in steel processing has low safety coefficients, making intensive continuous production difficult manually, but robots can achieve "two-shift operations," pushing capacity utilization towards 150%. The company's current capacity utilization is only around 86%, less than 90%, meaning there is significant room for capacity release with further robot promotion.

Ⅳ.Demand Logic: 70% Tied to Infrastructure, Clear Pro-Cyclical Elasticity

Cost advantages determine the "floor," while demand logic determines the "ceiling" – Honglu Steel Structure's demand side is entirely "infrastructure-oriented."

The data is clear: approximately 70% of its downstream demand comes from infrastructure-type construction (bridges, factories, transportation facilities, public venues, etc.), while demand related to real estate, such as super high-rise buildings and office buildings, accounts for only 28%. This means its demand performance depends corely on fiscal expenditure intensity and has very low correlation with the real estate cycle.

Although the entire steel structure industry entered a downward cycle starting in 2024, before that, it maintained a slight growth trend long-term. Once pro-cyclical trading kicks in – with PMI rising and PPI increasing – Honglu Steel Structure's price-raising ability will quickly manifest. Coupled with its low correlation to real estate, the "resilience" on the demand side could be stronger than market expectations, hence its pro-cyclical elasticity.

Ⅴ.Finance & Valuation: Clean Assets + Sufficient Safety Margin, 20 Billion CNY Market Cap Anticipated

Investment ultimately comes down to "valuation." Two key points deserve attention regarding Honglu's finances and valuation:

Financial End: Clean Balance Sheet, Low Capital Advance Pressure

Using the proportion of "Accounts Receivable + Completed but Unsettled Work + Contract Assets" to total assets to measure capital advance pressure, the results show: Honglu's ratio is extremely low, while peers like Jingong Steel Structure and Fuhong Steel Structure face more concerning capital advance situations.

Low capital advance pressure means more robust cash flow and stronger risk resistance, which is an important support for fundamental stability.

Valuation End: Sufficient Safety Margin, Clear Upside Potential

Based on report analysis and industry trend calculations, two core judgments can be made regarding Honglu's profits and valuation:

Upside Scenario (Pro-Cyclical Recovery): If rebar prices rise to 3,600 CNY/ton next year, coupled with the company's cost reduction and efficiency improvements, profits could reach 1.5 billion CNY. Applying a P/E of 15x would correspond to a market cap of approximately 22 billion CNY. If pro-cyclical trading gains momentum, breaking through the 20 billion CNY market cap should not be an issue.

Downside Scenario (Pro-Cyclical Lag): If rebar prices remain low at 3,300 CNY/ton, and company profits maintain 2024 levels, 2026 profits are estimated at around 1.0 billion CNY. Applying a P/E of 12-13x would place the valuation bottom around 12.1 - 13.1 billion CNY.

Looking at the weekly stock chart, during periods of extreme market pessimism in July-September 2024, the company's market cap bottomed around 9.1 billion CNY, while the normal low median is around 12 billion CNY. Currently, the company's valuation is within a safe range with a sufficient safety margin.

Ⅵ.Medium-to-Long Term Outlook: Dual Drivers of Capacity + Cost Reduction, Awaiting Sentiment Catalyst

Finally, the medium-to-long term logic – Honglu's growth is not limited to pro-cyclical elasticity but also driven by the dual engines of "capacity release + continuous cost reduction."

Capacity Aspect: Production is expected to be 5 million tons this year, with capacity of 5.5 million tons. By 2027, capacity and production are expected to reach 7 million tons and 6.7 million tons respectively. The logic of continuous production release is clear.

Cost Reduction Aspect: The advancement of robot substitution and improvements in operational management efficiency will continue to lower unit costs. Even without rising steel prices, the company can achieve steady growth solely through "volume increase + cost reduction."

However, note that the A-share market often requires "sentiment catalysts" to unlock fundamental value. If the current PMI-related pro-cyclical trade successfully initiates, it could likely become the "catalyst" for the market to discover Honglu Steel Structure's value.

Summary: A "Elasticity + Stability" Target in a Pro-Cyclical Context

In summary, Honglu Steel Structure's investment logic is clear:

Short-term: Tied to the infrastructure track, clear pro-cyclical elasticity, sufficient valuation safety margin.

Medium-to-Long Term: Capacity release + continuous cost reduction, robust growth logic.

Moving forward, continuously track pro-cyclical indicators like PMI and PPI, as well as the progress of the company's robot substitution rate, to capture layout opportunities brought by sentiment catalysts.

![[Industrial Quality & Growth Tour] Huanggang’s “Steel Giant” Powers Over 5,000 Global Landmarks!](/source/ec51371e707c92a8153fe7505315d6a1/2-3.jpg)